Stablecoin Fees on Tempo

Tempo enables users to pay transaction fees in any stablecoin, including custom-issued tokens and tokenized deposits, no volatile gas token required. Stablecoin fees are native to the protocol and deliver transparent, predictable costs and simpler accounting. Work with our infrastructure partners rolling out stablecoin fee support, including Bridge, Frax, and MetaMask, or start building with our docs.

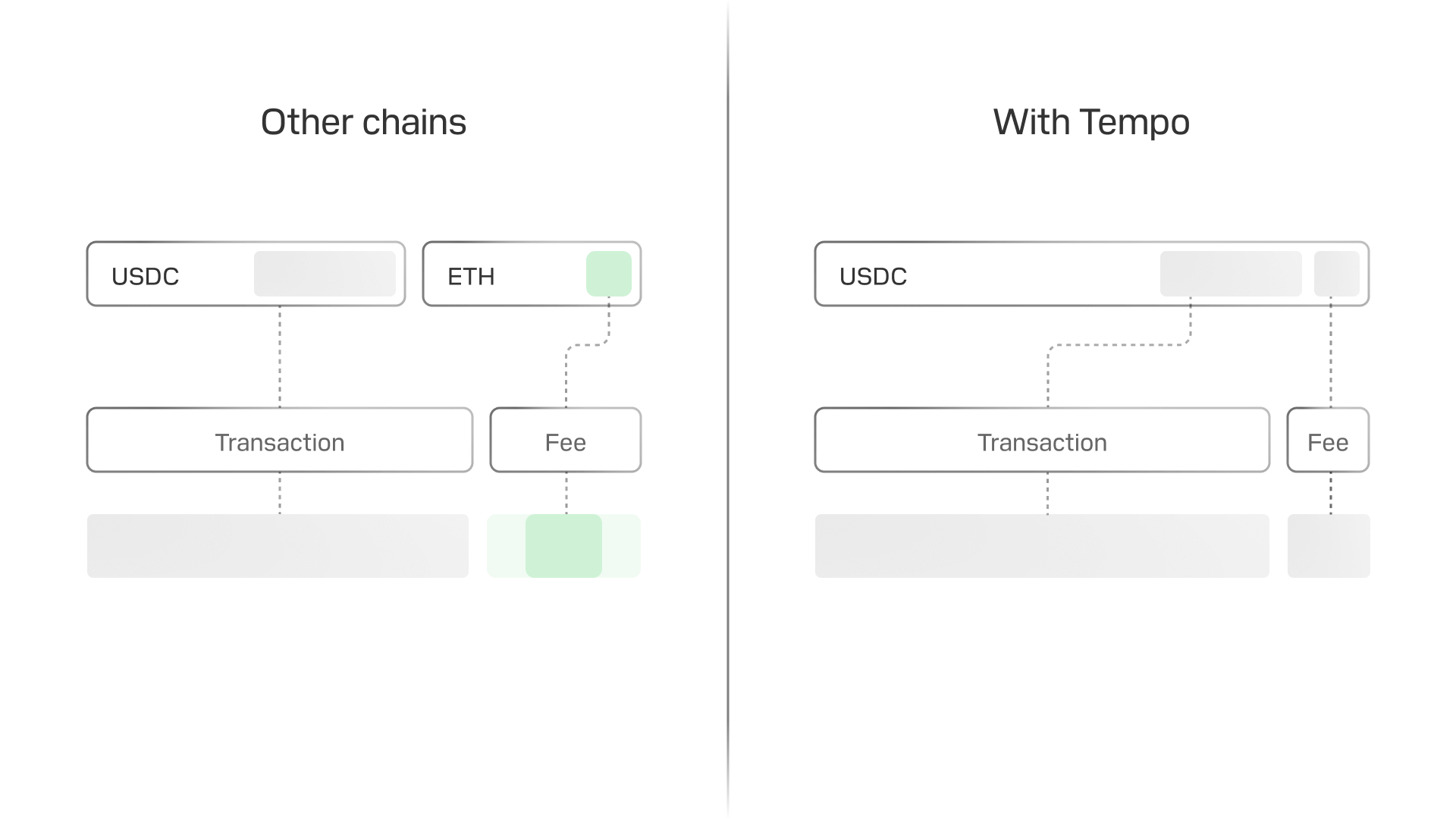

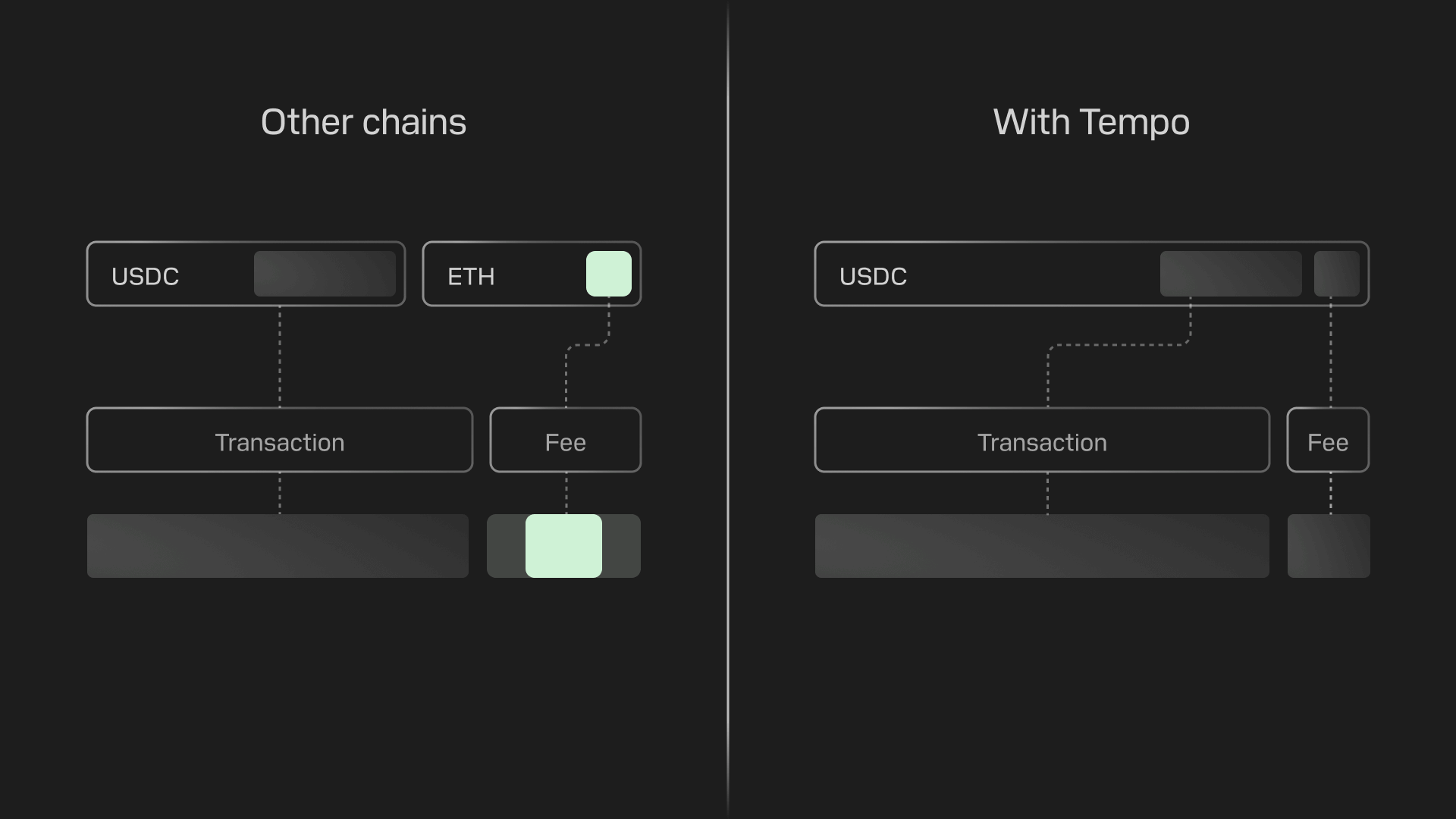

Institutional adoption of stablecoins has been held back by a surprisingly small detail: the "gas token." On most blockchains, sending stablecoins means holding a separate, often volatile token just to pay transaction fees. Companies end up managing a second balance, funding it at the right times, and explaining it to their accountants and auditors.

Tempo takes a different approach. Designed for payment use cases, it allows fees to be paid in stablecoins at the blockchain level: fees are treated as part of the payment flow, and the blockchain handles the mechanics needed to make stablecoin fees work reliably at scale.

The case for fees in stablecoins

On Tempo, transaction fees can be paid in any supported stablecoin, including custom-issued tokens and tokenized deposits. Users pay fees in the same asset they already hold, and the protocol handles the rest.

This matters because most blockchains require a separate, often volatile token just to pay fees. "Gas tokens" introduce operational overhead: additional accounting, potential tax consequences when the token is sold to pay fees, and processes that many treasury teams are not set up to run day to day. They also carry steep capital charges, since banks must hold far more regulatory capital against volatile crypto assets. Stablecoins, by contrast, align with the fiat currencies these institutions already manage.

There is also a regulatory dimension. Stablecoins increasingly operate under clear frameworks like the GENIUS Act, with defined rules for reserves, audits, and compliance. Volatile gas tokens often exist in regulatory gray areas, creating compliance uncertainty, and in some cases, preventing enterprises from holding such tokens on their balance sheet altogether. By paying fees in regulated stablecoins, companies avoid this ambiguity.

Alternatively, companies can pay for a gas abstraction service, but this adds extra costs and requires additional integration work; further, critically, it still leaves them exposed to unpredictable costs driven by volatile token prices.

By enabling fees to be paid in stablecoins, Tempo delivers the accounting simplicity, operational efficiency, and regulatory clarity enterprises require. Fees become a clean, auditable line-item expense, denominated in the same units as the payments themselves.

The building blocks behind stablecoin fees

Enabling any stablecoin to be natively used for network fees requires deep protocol integration. Tempo achieves this through two core components:

TIP-20 token standard

Tempo's native token standard extends ERC-20 with features essential for payment use cases: memos for reconciliation, built-in compliance controls, and the ability to serve as fee tokens. Only TIP-20 tokens can be used to pay transaction fees on Tempo.

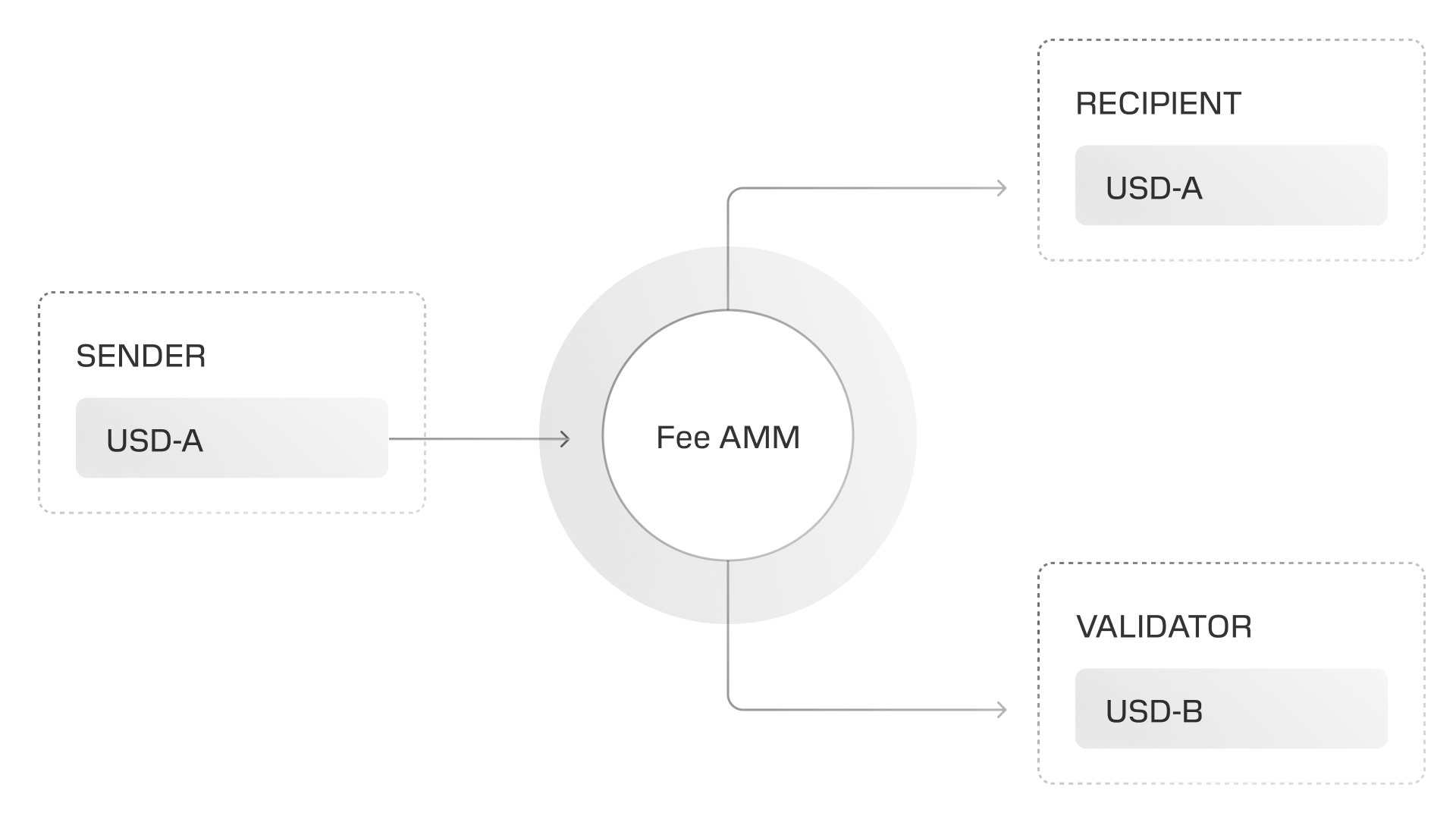

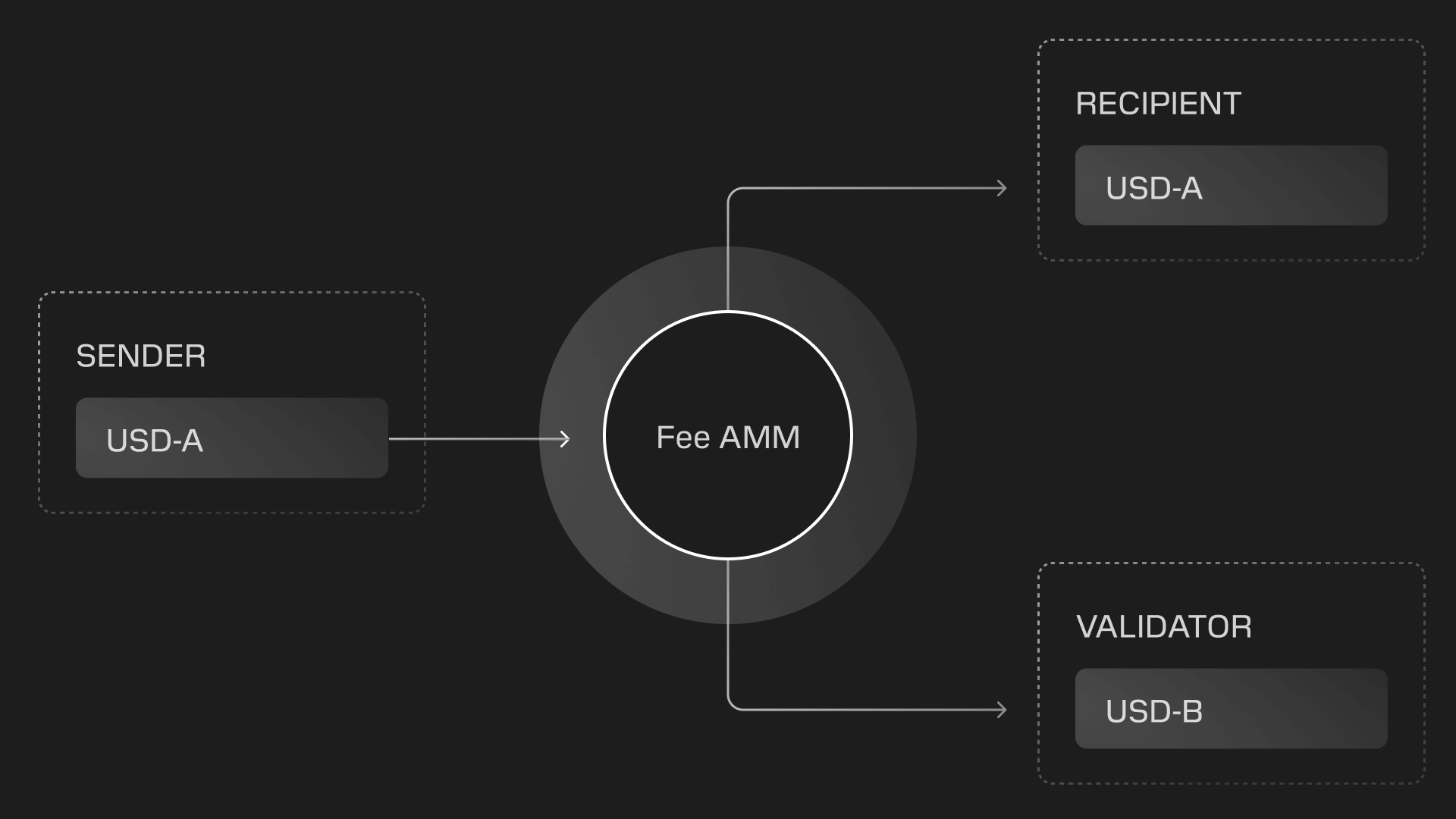

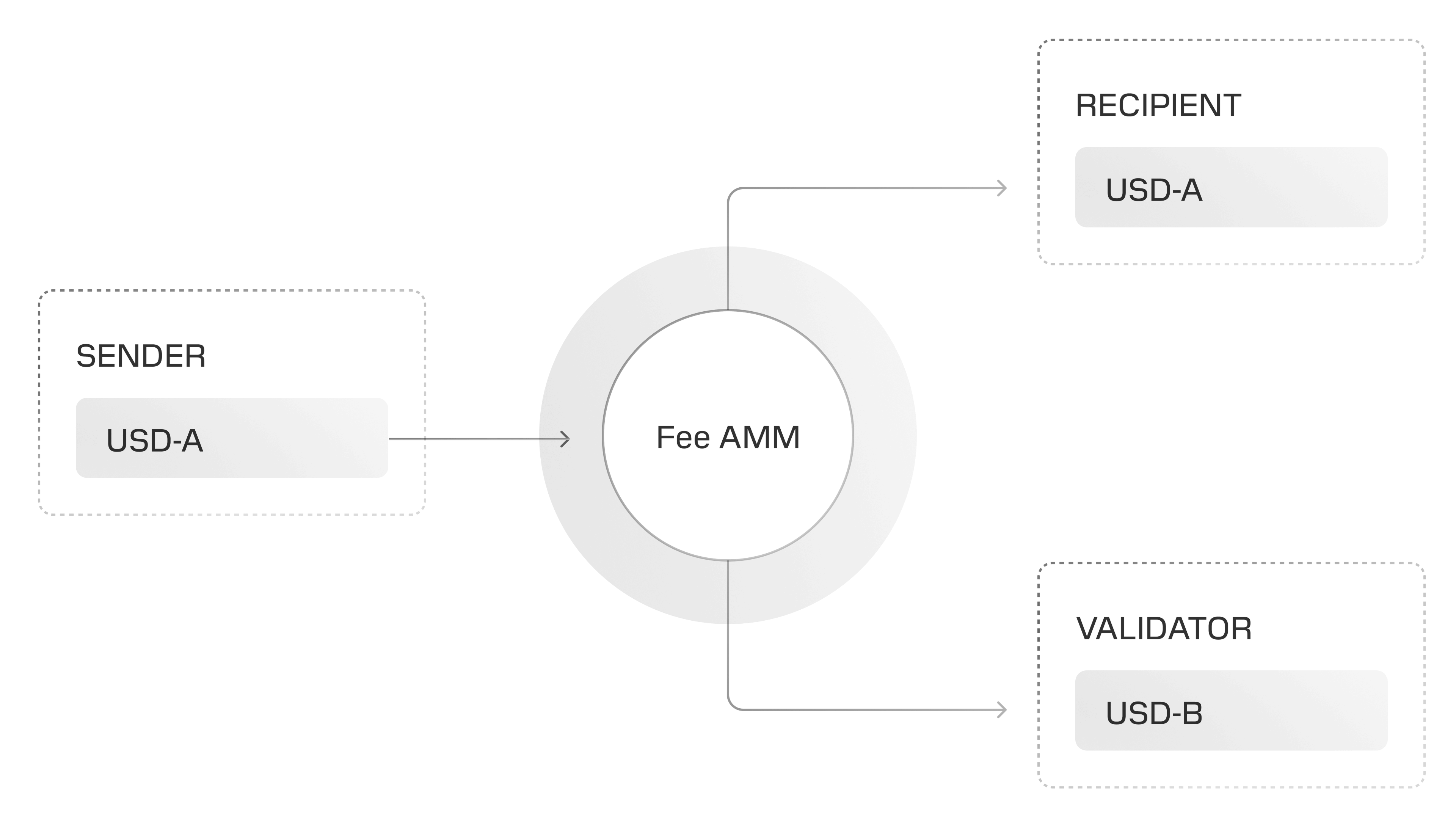

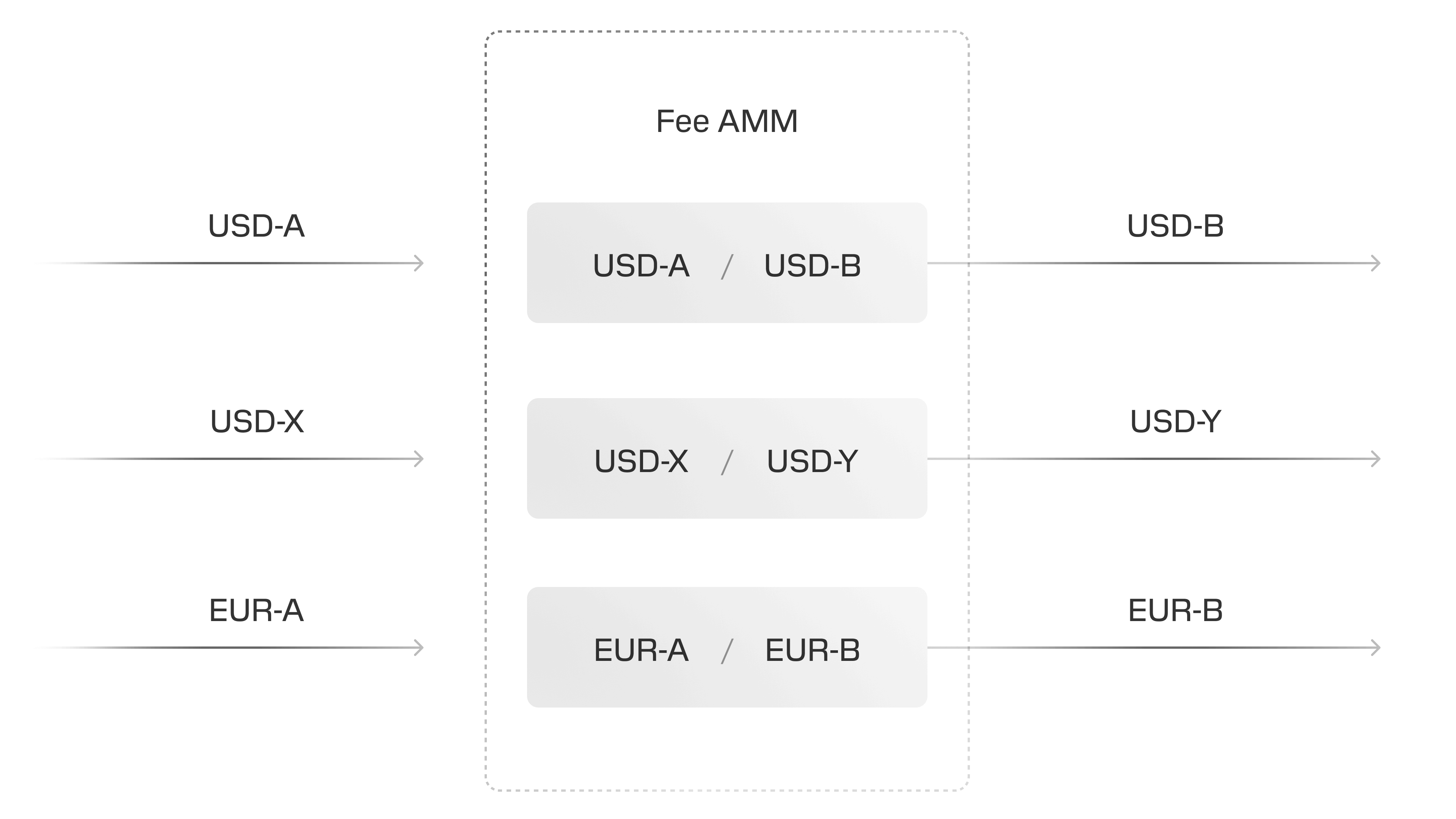

Fee AMM

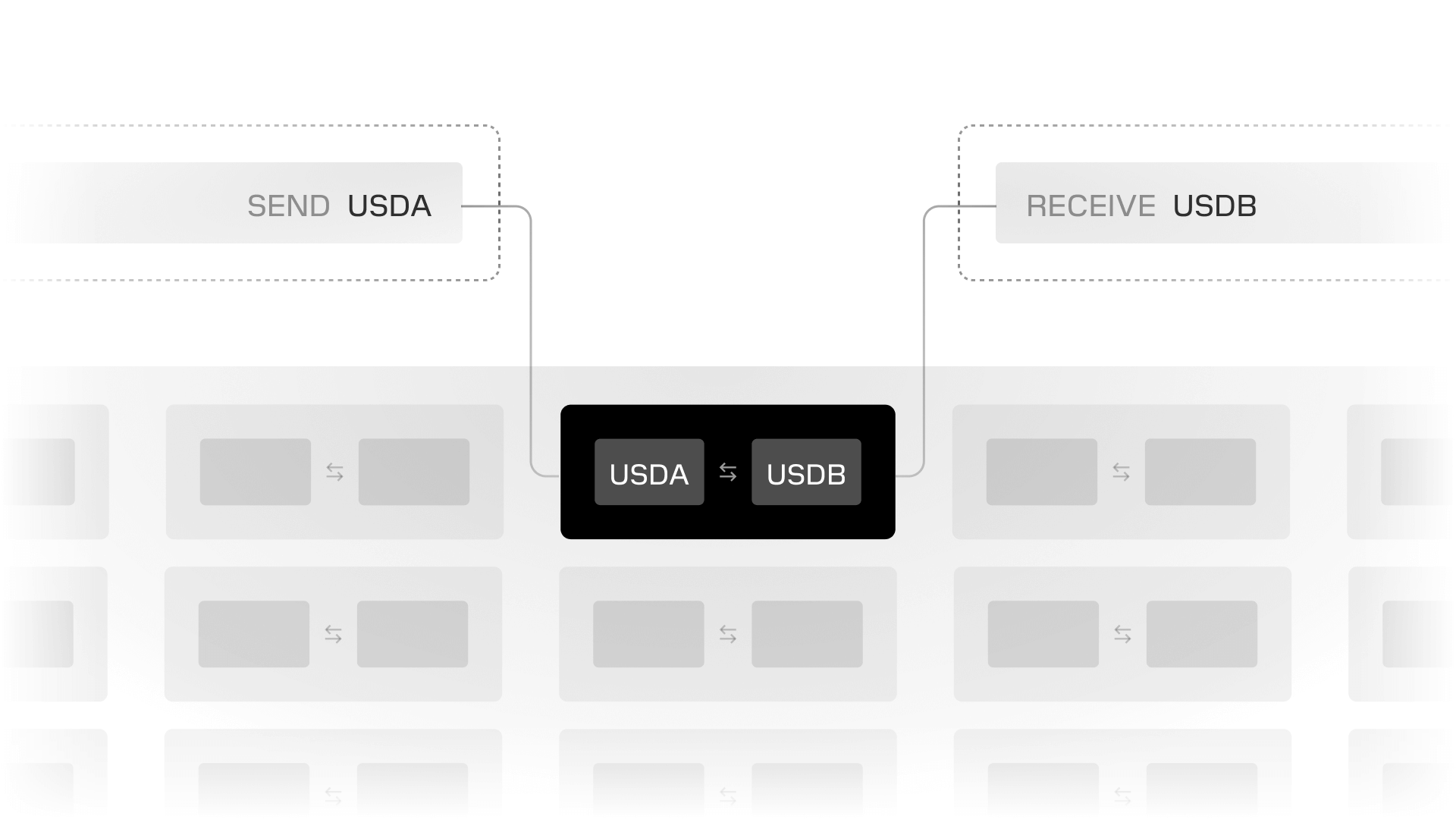

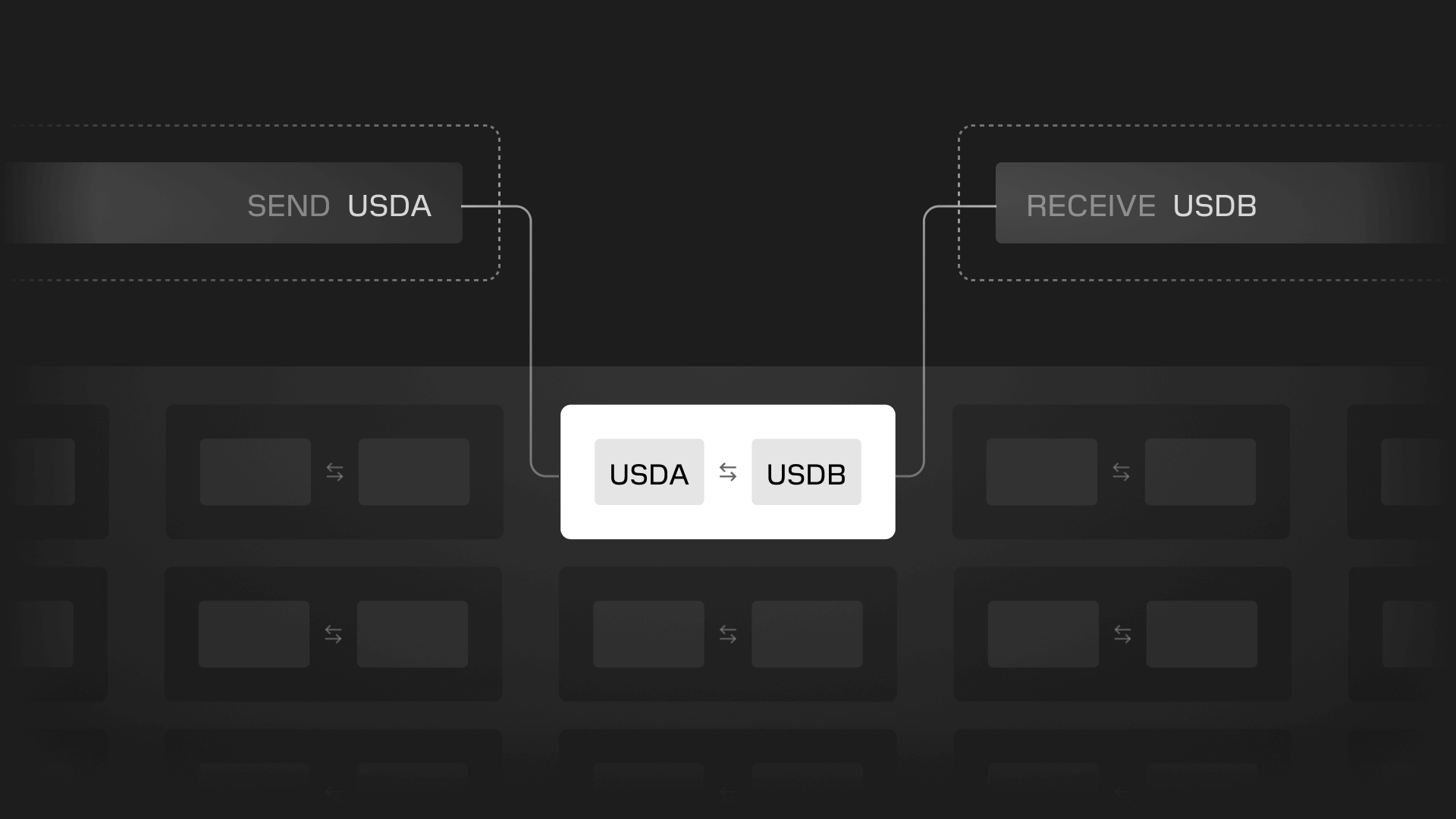

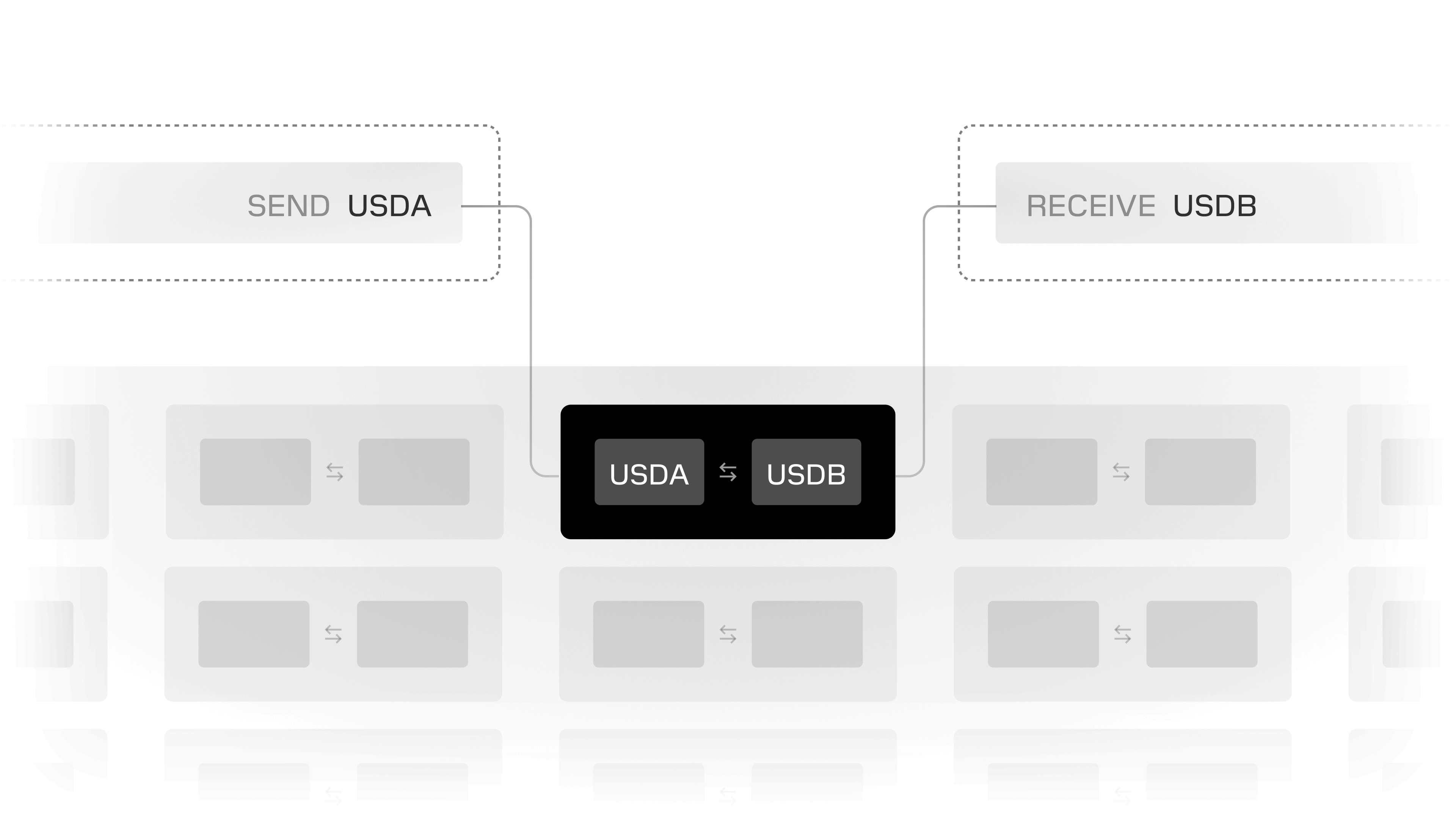

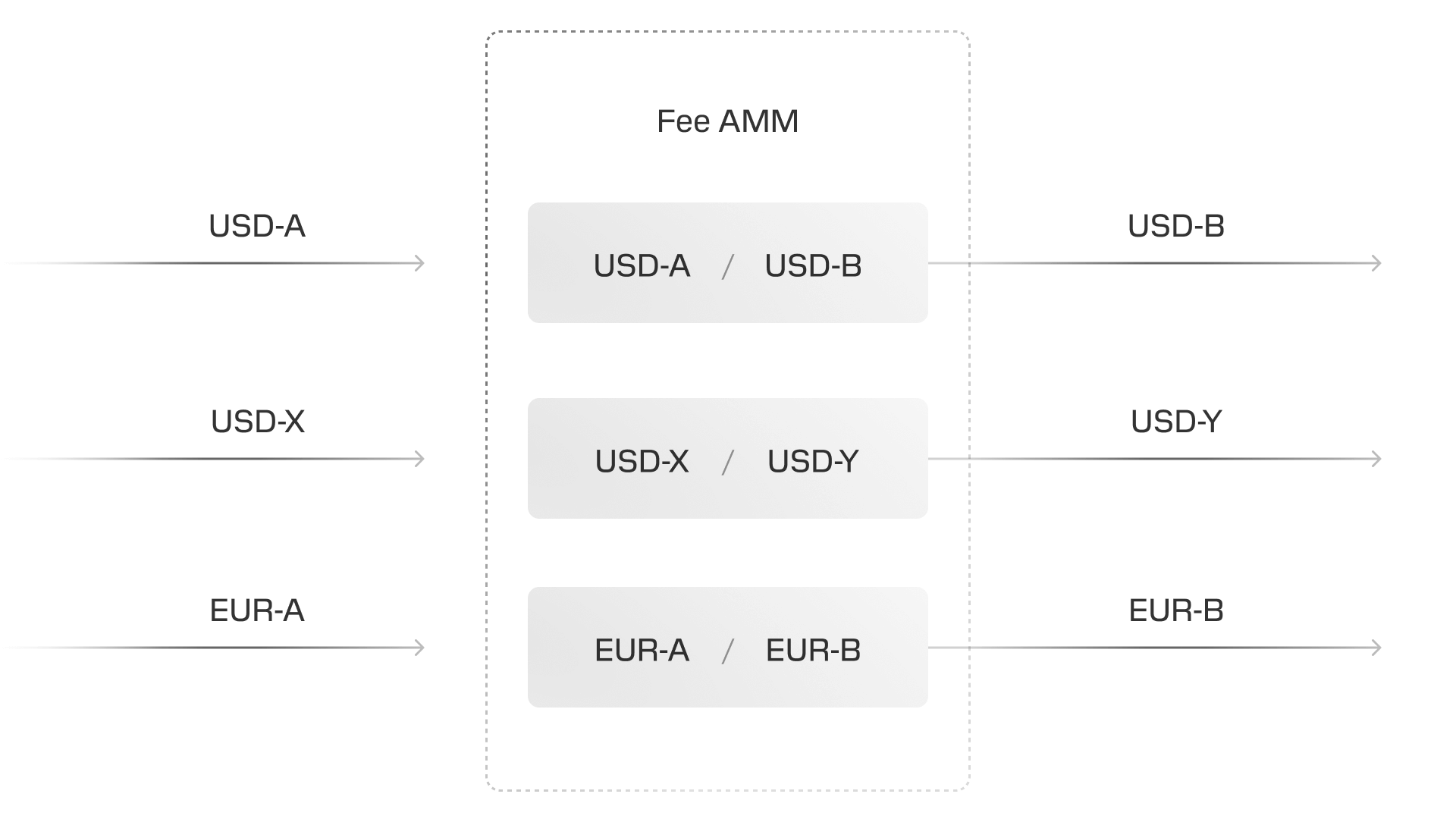

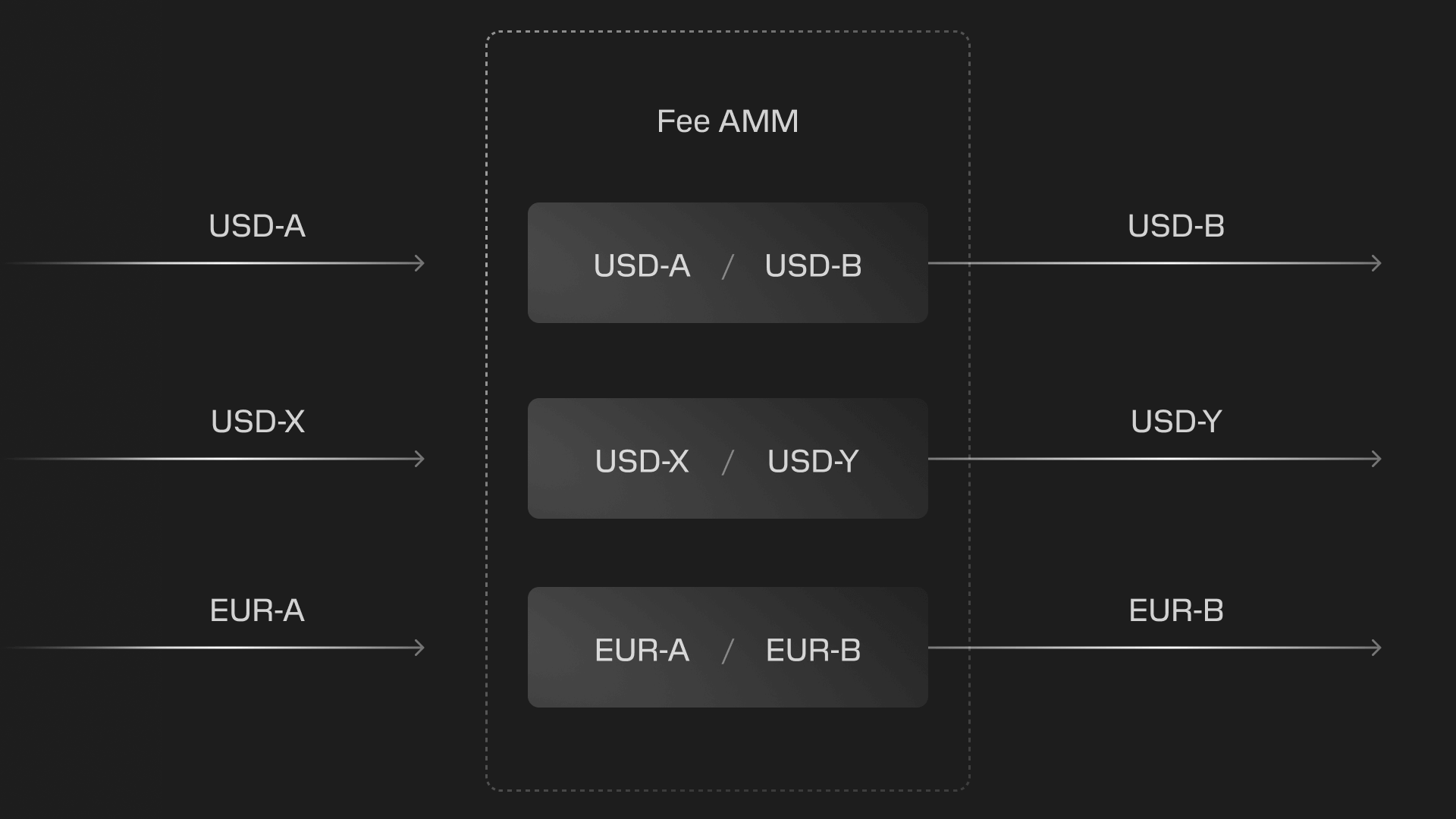

This protocol-native automated market maker handles fee conversion between stablecoins. If a payer prefers USD-X but the validator wants to receive fees in USD-Y, the Fee AMM performs this conversion automatically at a fixed rate, as part of the user's transaction.

Tempo's payment-first design, native token standard for stablecoins, and the ability to pay fees in any stablecoin create the conditions for a thriving stablecoin ecosystem. To support this, we built the Tempo Stablecoin DEX, a protocol-native exchange designed specifically for stablecoin trading.

How stablecoin fees work on Tempo

Paying fees in stablecoins on Tempo is straightforward. The protocol handles the complexity.

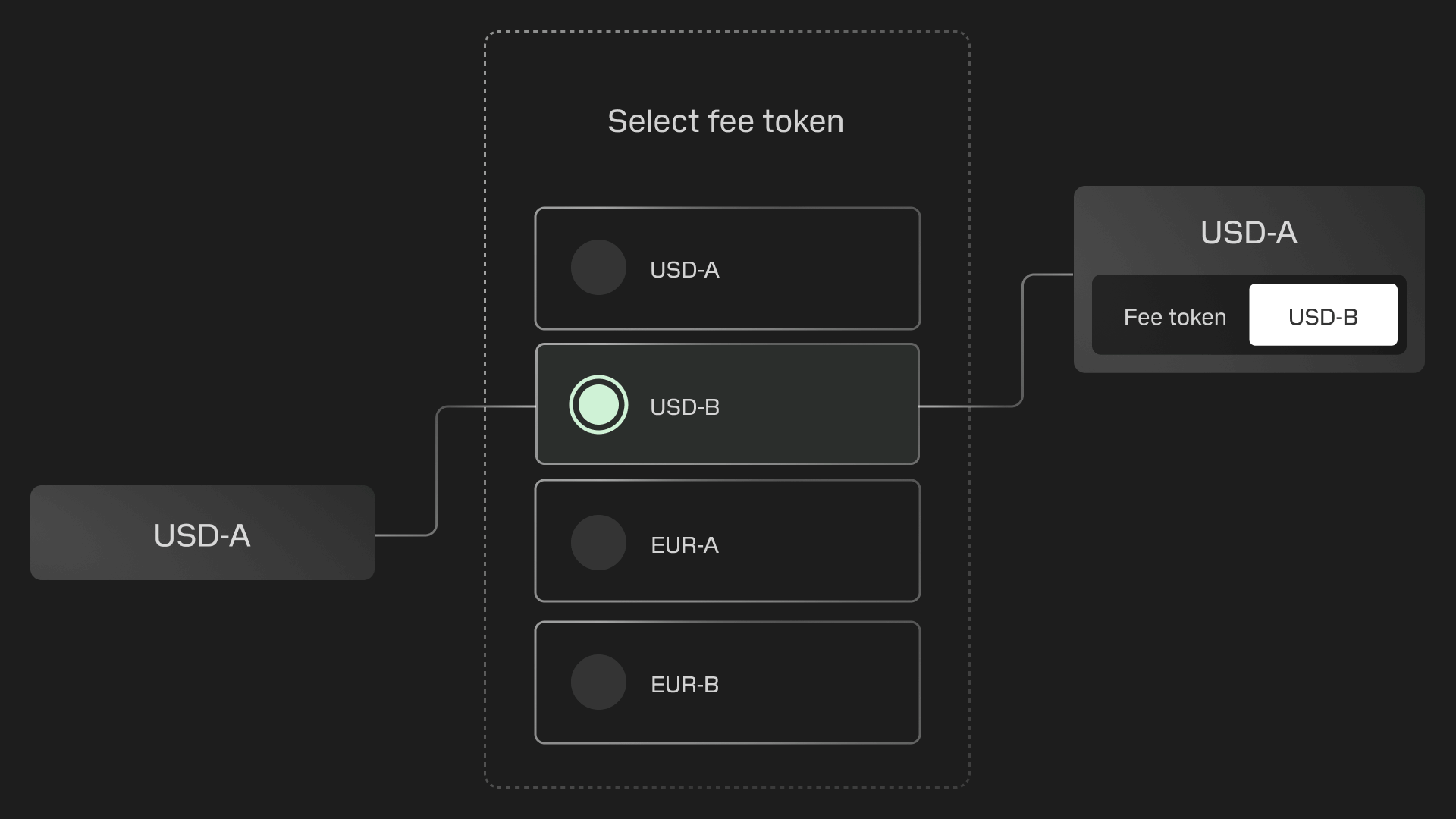

Fee token selection

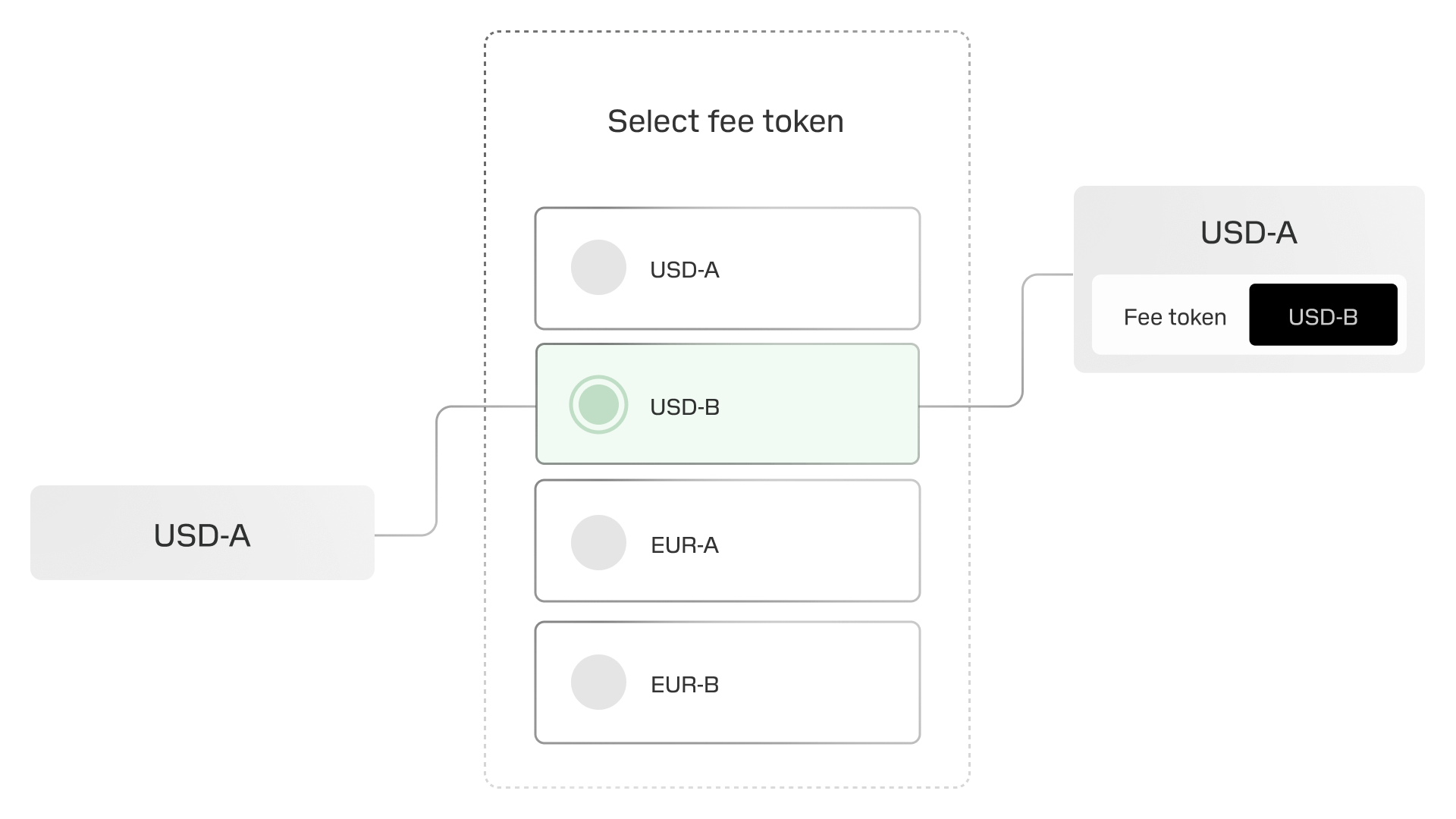

When submitting a transaction, choose which TIP-20 stablecoin to use for fees. Tokenized deposits are also supported. You can also set fee preferences at the account level. If no preference is specified, fees are paid in the same token as the payment. No extra decisions, no extra balance to manage.

Supported stablecoins

Today, any USD-denominated TIP-20 stablecoin can be used to pay fees. Support for non-USD stablecoins will be added as those markets develop. This will eliminate FX complexity for companies operating in non-USD currencies, keeping both payments and fees in the same currency.

Automatic fee conversion

Validators specify which stablecoin they want to receive fees in. When there is a mismatch, the Fee AMM performs an automatic conversion. These swaps execute at a fixed rate, with liquidity providers earning 0.3% per swap.

Liquidity and routing

For a stablecoin to be accepted as a fee token, it needs sufficient Fee AMM liquidity. The Fee AMM performs direct conversion between any two stablecoins, ensuring concentrated liquidity and efficient pricing.

Putting the pieces together

Here is how it works in practice. A company submits a payment transaction and selects USDX as their fee token. A validator building the next block includes this transaction but prefers to receive fees in USDY. The Fee AMM automatically handles the conversion from USDX to USDY within the same transaction. The company pays in their preferred stablecoin, the validator receives theirs, and liquidity providers earn fees on the swaps.

Learn more about stablecoin fees in our docs.

Who benefits from stablecoin fees

Stablecoin fees create value across the entire payment ecosystem, from the companies making payments to the validators securing the network:

Payers: A company running global payroll can fund their Tempo account with any stablecoin and execute thousands of payouts without ever needing to acquire or manage a volatile gas token. Their fee expenses are predictable, easy to forecast, and integrate cleanly into existing accounting systems.

Validators: Validators receive their fee revenue in stable, liquid assets they can immediately use. The result: more predictable economics and simpler operations.

Neobanks and fintechs: Applications can sponsor transaction fees for users using stablecoins from their own treasury. This creates a "gasless" experience that feels like a traditional fintech app without crypto friction or complexity.

Payment processors: As protocols like "x402" emerge, native onchain payment processors will be able to collect and pay fees in stablecoins, simplifying their own operations and business models.

Market makers: Liquidity providers earn fees on every swap that occurs through the Fee AMM and Stablecoin DEX. We expect Tempo to host thriving stablecoin markets with deep liquidity.

Start building with Tempo

Whether you're exploring stablecoins or already use them in your payment stack, we can help you get started:

For guidance on choosing the right approach for your use case, reach out to us at partners@tempo.xyz.